The Waterfall Advantage

Get multiple financing options for your customers in seconds. No social security number required, and no impact on your customers’ credit.

By the Numbers

60%

Estimated increase in financing when using Waterfall

25%

Higher sale value on average when a customer finances

77%

Customers say financing influences their buying decisions

Frequently Asked Questions

We’ve put together some commonly asked questions to give you more information about Waterfall Credit.

Visit this page for more frequently asked questions.

For further inquiries, please send us an email at support@waterfall.credit

Visit this page for more frequently asked questions.

For further inquiries, please send us an email at support@waterfall.credit

Waterfall is a must have platform that allows retailers to check customer eligibility for

financing options across multiple institutions, all at once in seconds. We don't place a

hard inquiry on your customer's credit, meaning you can instantly find the best financing

option without impacting their credit.

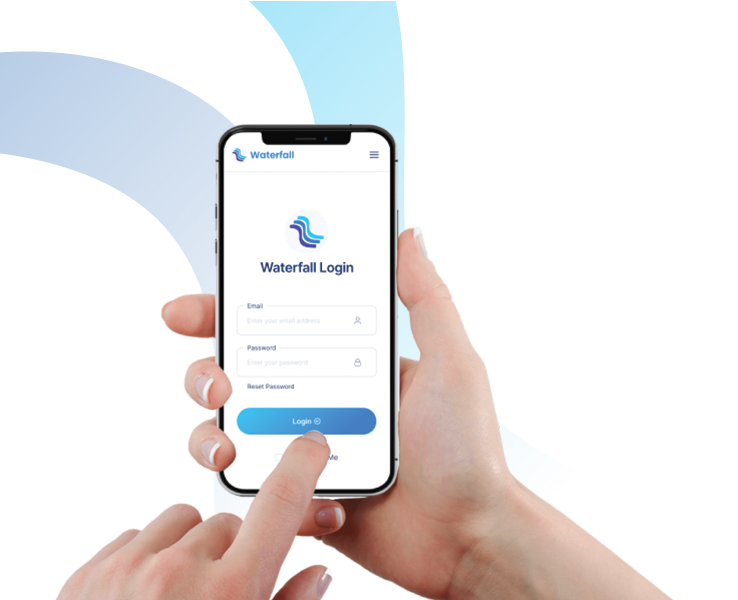

Waterfall Credit is a must have platform for retailers. Designed for fast-paced retail

environments, the platform removes guess work for the financing process. Employees

often do not utilize all financing options available to the customer, resulting in millions of

dollars of potential lost revenue every year.

Most employees do not make the effort to obtain the best financing options for their customer. They’ll usually run financing from one company, and if not approved, would allow that customer to leave. This is because of multiple reasons including laziness, underestimating a customer, a lack of time, or because the customer doesn’t want too many inquiries on their credit. They do not take the time or have the ability to determine which will be the least expensive option for the retailer to offer financing and they choose whatever they are comfortable using. This results in hundreds of thousands in extra fees (MDF) to the retailer. With Waterfall, the entire process is automated. A retailer can also gauge each employee’s performance on the financing side of their business.

Most employees do not make the effort to obtain the best financing options for their customer. They’ll usually run financing from one company, and if not approved, would allow that customer to leave. This is because of multiple reasons including laziness, underestimating a customer, a lack of time, or because the customer doesn’t want too many inquiries on their credit. They do not take the time or have the ability to determine which will be the least expensive option for the retailer to offer financing and they choose whatever they are comfortable using. This results in hundreds of thousands in extra fees (MDF) to the retailer. With Waterfall, the entire process is automated. A retailer can also gauge each employee’s performance on the financing side of their business.

It’s Quick. Waterfall saves you time, allowing you to know your customer’s financing

eligibility in seconds instead of hours across many lenders.

Customer Satisfaction. Quickly know your customer’s eligibility prior to them being hit with a hard inquiry on their credit file by a lender.

Increase Revenue. Waterfall allows you to maximize your upsell potential by providing multiple financing options in seconds which results in an increase in revenue.

Decrease Financing Cost. Waterfall is designed to decrease the retailer’s average cost of financing by displaying average financing costs for each available financing plan.

Score Better MDF with your lenders: Waterfall Credit pre-qualification minimizes decline applications on lender platform, many lenders will review your merchant accounts periodically to determine your percentages of declined applications, if you have less declined applications on their platform, they will usually upgrade your store to Tier 1 preferred rates which are substantially lower than lower tier rates resulting in substantial savings.

Robust Reporting. Waterfall reports employee performance on sold, walked or pending deals, total approved credit limits, number of sales made, and how much potential business is pending with approved customers.

Marketing Suite. Waterfall benefits retailers with incredible marketing, which can be set on autopilot, which allows you to send special offers on your customer’s birthday and other occasions by reminding them of their approved credit limit with the retailer.

Increase Reviews. Waterfall can also be utilized to automate customer reviews on Google and other platforms. There’s no need to purchase expensive review platforms when you have a Waterfall.

Customer Satisfaction. Quickly know your customer’s eligibility prior to them being hit with a hard inquiry on their credit file by a lender.

Increase Revenue. Waterfall allows you to maximize your upsell potential by providing multiple financing options in seconds which results in an increase in revenue.

Decrease Financing Cost. Waterfall is designed to decrease the retailer’s average cost of financing by displaying average financing costs for each available financing plan.

Score Better MDF with your lenders: Waterfall Credit pre-qualification minimizes decline applications on lender platform, many lenders will review your merchant accounts periodically to determine your percentages of declined applications, if you have less declined applications on their platform, they will usually upgrade your store to Tier 1 preferred rates which are substantially lower than lower tier rates resulting in substantial savings.

Robust Reporting. Waterfall reports employee performance on sold, walked or pending deals, total approved credit limits, number of sales made, and how much potential business is pending with approved customers.

Marketing Suite. Waterfall benefits retailers with incredible marketing, which can be set on autopilot, which allows you to send special offers on your customer’s birthday and other occasions by reminding them of their approved credit limit with the retailer.

Increase Reviews. Waterfall can also be utilized to automate customer reviews on Google and other platforms. There’s no need to purchase expensive review platforms when you have a Waterfall.

It only takes a few seconds once you apply.